Heartwarming Tips About How To Sell Puts

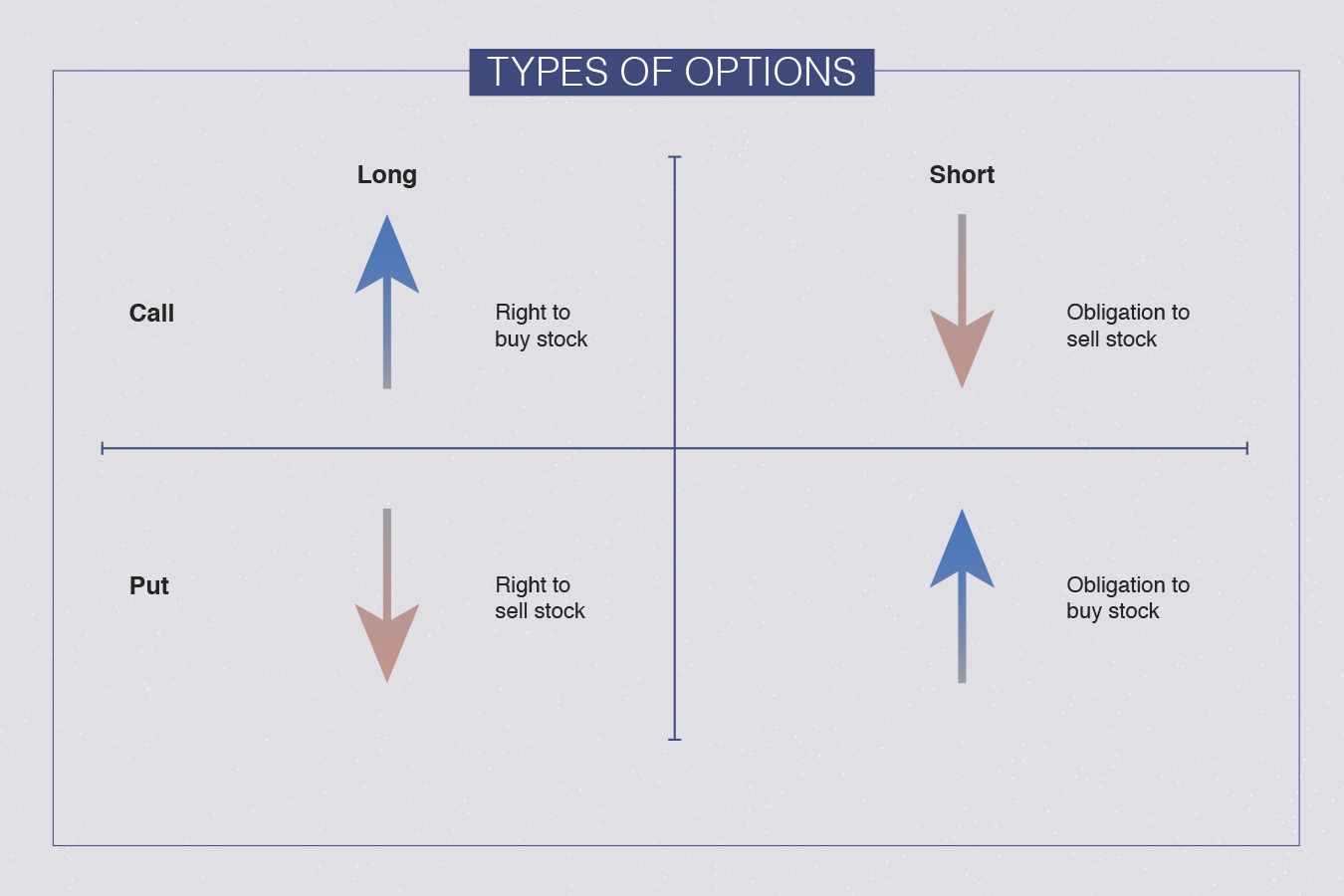

They think that you can only buy a put or buy a call, but this is not the case.

How to sell puts. Two simple rules for put selling like the stock like it at the strike price Short puts may be used as an alternative to placing buy limit orders. Sell puts for trading purposes, with the goal of generating a.

When it comes to selling put options, i engage in 2 key strategies: Generally, you should choose the stock that you don’t mind holding for the long term. We have other thinkorswim tutorial videos as well!

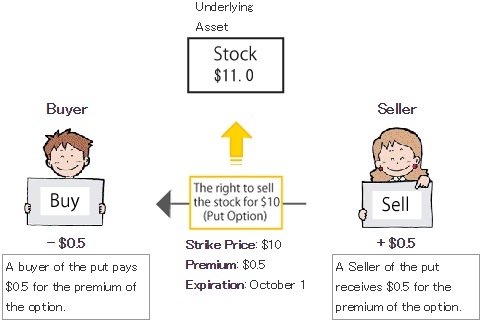

My general rule for put selling is to collect 1% minimum of the strike sold. When you sell a put option, you're signing a contract to buy 100 shares of the underlying stock at the strike price, but only if the share price comes below this. Let us take an example.

Trader wants to own 100 shares of yhoo if price goes down to $49. They think that you can only buy. Sell a put option with a strike price near your desired purchase price.

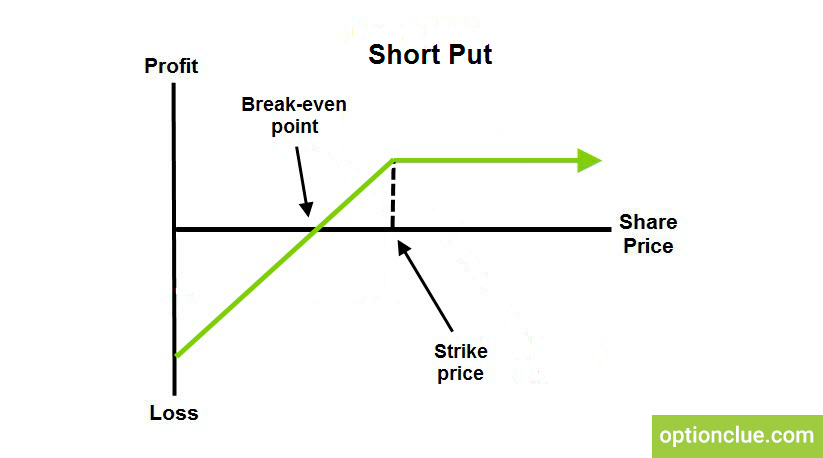

Just like selling a call, selling a put generates limited gains with potentially unlimited losses. This is well illustrated by the profit/loss curve of a short put. A put option gives the buyer the right to sell the underlying asset at the option strike price.

You will collect a premium for doing this because you are giving someone else the right to purchase a put at that same strike. How to sell puts for income this video is all about td ameritrade options trading, today, i’ll focus on how you can sell puts. Yhoo current market price = 49.70.

And since you need to set aside a collateral first before selling cash secured put, you can. At which point, the buyer on this. Determine the price at which you’d be willing to purchase the stock.

Find a stock (or etf) you would like to buy. You sell a put on aapl with a $150 strike price. Sell puts to own a stock at a discount and 2.

That means i need to collect.30 minimum on a 30 strike put as an example. This is a quick thinkorswim tutorial on how to sell puts. Check out the thinkorswim playlist:

1% is the minimum, not.

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)